S3T Mar 13: Bretton Woods 3, The next consumer mkt, Rethinking growth, Wind wins, This summer's frogs...

As the Ukraine conflict continues amid debate about the future of fossil fuel driven geopolitics and the global money system, new indicators - generation-defining stats - offer glimpses of what is to come. This is our chance to rethink economic growth.

Hints of what is to come

Steph Smith has accumulated a set of "generation-defining stats" worth paying attention to. See the thread below, and consider what actions you might take based on this list of mind-boggling changes underway?

In 1994, Jeff Bezos famously spotted a stat that made him leave his high-paying PE job to start Amazon:

— Steph Smith (@stephsmithio) March 8, 2022

💡 The Internet was growing 2300% per year.

What are the generation-defining stats of today?

I'll post a few to kick things off...

Bretton Woods 3?

This week Credit Suisse investment strategist Zoltan Pozsar published a client note (PDF) outlining his concerns that the Ukraine conflict and sanctions create an opening for global trade mischief in the East which could fuel instability and inflation in the West, with the potential demise of the dollar.

Pozsar's thesis - that we are moving into a 3rd phase of "Bretton Woods" where currencies are backed by commodities - was widely covered as bullish for bitcoin and the next financial world order (Yahoo, Nasdaq, Forbes), though to me this feels premature.

Pozsar's analysis of the rift between sinking prices for Russian based commodities vs. skyrocketing prices of non-Russian commodities seems spot on, but not everyone agrees with Pozsar's analysis of the implications:

- Alex Turnbull counters with a slightly different take noting the multi-pole trade and shipping arrangements that seem to be emerging, as well as the potential benefits of accelerating the "demise of fossil capitalism."

- Mona Ali sees this as actually strengthening the US Dollar as a "money-military matrix backed by legal supremacy" and worries about the perpetuation rather than the demise of fossil fuel hegemony.

Pozsar's note is fairly technical so I recommend NLW's 3/11 podcast where he reads excerpts and provides very helpful context and explanations.

For me, the note and the discussion around it underscore 3 themes:

- Crypto Adoption Continues. Bitcoin will continue to be seen as a hedge for investors concerned about macro. Crypto in general will continue its adoption curve (see Next Consumer Market segment below for reasons why).

- Market Volatility. Rampant uncertainty will force institutional investors - or any investors who can be fired for being wrong - to change their thesis and allocations more rapidly than usual, and this will likely increase volatility.

- Digital Products. Products and experiences that can be delivered and enjoyed digitally will continue to grow in appeal in contrast to physical, manufactured products deprecated by supply chain gridlock and inflation. (Reused/recycled/vintage products that are not impacted by global supply chains may also get a boost). More about this in the Next Consumer Market segment below.

The Next Consumer Market

Data suggests that crypto adoption will grow 5x by 2027 to about a billion users up from the current estimate of ~200M. This new generation of consumers will presumably be focused on the 4 kinds of consumer experiences that crypto enables (and the global status quo can't):

- Digital products that enhance the portion of their lives lived online.

- Financial services that offer more flexibility, equal access and cost effective capabilities.

- Physical mobility empowered by borderless digital money that can be sent or used anywhere.

- Participation in the governance and impact of decentralized organizations and projects.

This is economic growth, but it can be a very different kind of growth. In fact, we have the opportunity to rethink growth: to move beyond the false trade off between growing the economy vs. sustaining our natural ecosystems.

Rethinking Growth

The false trade off between economy vs. ecosystem is based on an underestimation of the different forms economic growth can take. We have pinned the entire economy on an overly narrow definition of economic growth: people spending more and more $ on stuff, generated by a cycle which requires depletion and pollution of the world.

This specific kind of narrowly defined growth comes with 2 side effects:

- Malignant environmental impacts that are hard to reverse.

- Vulnerability to geopolitics which are hard to manage (as current events illustrate).

In the conventional wisdom of many economic decision-makers, this kind of growth must continue at all costs or else the economy will collapse. The rapidly created value and volume in the crypto space suggests otherwise.

Being a consumer of massive amounts of physically manufactured goods is not the only way or even the best way to have a satisfying and secure life. There are ways to experience contentment and wealth that have nothing to do with manufacturing supply chains, shopping malls or landfills.

As the adoption curve of crypto plays continues over the next few years, it will be interesting to see how this plays out.

Nature Notes

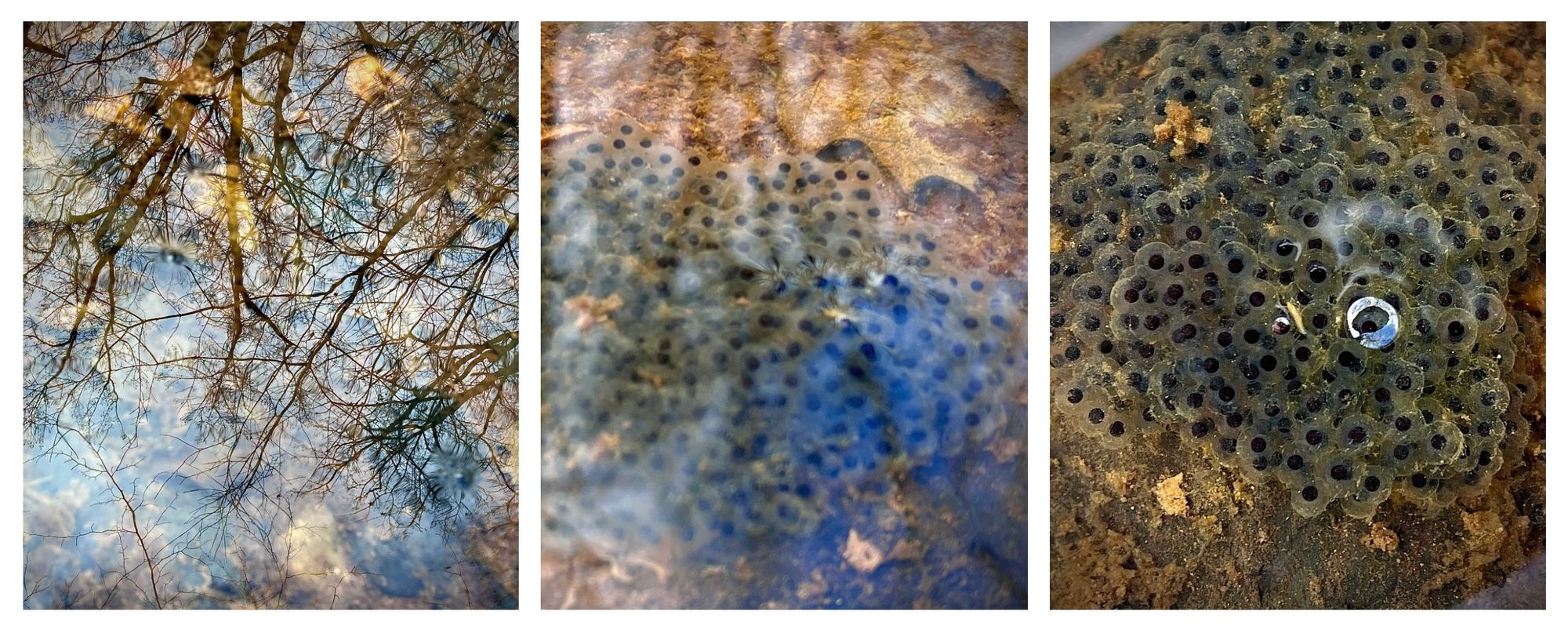

This Summer's Frogs

Watch for quiet pools of water along streams or low lying areas in forests, and you might get a glimpse of egg clusters of one or more species of water frogs. This family includes the common frogs we see and hear in the summer: Leopard Frogs, Bullfrogs and more. The photos above document an egg cluster I found along New Hope Creek in Durham NC. Related: Smithsonian's 14 Fun Facts About Frogs.

The Wind is Winning

The recent auction of offshore wind development rights netted $1.5B in bids from multiple bidders planning to harness wind energy sufficient to power 2 million homes. By contrast the recent drilling rights auction in the Gulf of Mexico netted less than $200M in bids.

Final Note

Hope you enjoyed this week's note. Thank you again for reading. Its fine to forward to friends and colleagues. To join the conversation, please visit S3T Discord or Twitter. Stay safe and have a good week.

Ralph

Opinions mine. Not financial advice. I may hold assets discussed.

Member discussion