🎢 S3T Aug 16 - Green growth in Red States, and Antarctica, AI Risk List, Cosine Genie...

Welcome to S3T, the essential newsletter, podcast, and learning platform for change leaders. Every week we review the top developments and insights you need to stay ahead of the curve, build your ethics & leadership skills, and drive intentional beneficial innovation.

🎧 Listen to this episode on the S3T Podcast - Be sure to follow the S3T podcast so you never miss a show!

In this edition of S3T:

- 🎯 Stay Ahead of the Curve: S3T delivers top insights and developments weekly to keep you on the cutting edge of change leadership and innovation.

- 📉 Economic Complexity: Understand the shifting economic landscape, with a focus on the Federal Reserve's evolving approach to inflation and the impact of corporate pricing power.

- 🌱 Green Energy Impact: Red states are major beneficiaries of green energy investments from the Inflation Reduction Act, challenging traditional political stances.

- 📊 AI Risk Management: Leverage MIT’s comprehensive AI Risk Repository, a critical tool for navigating the complex risks associated with AI implementation.

- 🤖 AI Rivalry & Risks: The intense competition between Snowflake and Databricks in AI could lead to risky customer experiences due to hasty acquisitions and aggressive strategies.

- 🛠️ AI Coding Tools - Trust but Debug: While AI coding tools are improving, they still require skilled developers to ensure quality, emphasizing the importance of technical expertise.

- 🧠 Economic Literacy: Economic awareness is vital in change leadership as traditional frameworks evolve due to AI, robotics, and renewable energy by 2030.

- 🌍 Environmental Insights: Surprising findings from Antarctica's first vegetation survey highlight the planet's changing environment.

Opinions expressed are those of the individuals and do not reflect the official positions of companies or organizations those individuals may be affiliated with. Not financial, investment or legal advice. Authors or guests may hold assets discussed.

The ups & downs, the credit & the blame

Last week the market was convinced we were plunging into a recession and demanding immediate rate cuts.

This week sales rose and jobless claims fell - and the market was like, oh, well, we can wait til September for the rate cuts. We might have overreacted just a little.

Headline inflation - the figure favored by the Federal Reserve - dropped to 2.9% - as companies slash prices to retain cost-conscious consumers facing a job market riddled with hiring freezes. The drop raised hopes of interest rate cuts in September.

Both sides of the political spectrum jumped on the news:

- The White House's explanation (good charts in here btw) sought to take credit for an improving economy - while acknowledging further down in the post that this is a mixed situation and that families are struggling.

- The other side issued official House of Representatives press releases like this one (a thinly veiled political ad appearing in the top of Google search results) which correctly point out the cumulative impact of perennial inflation but incorrectly pin the blame solely on the current administration - while conveniently ignoring the GOPs significant contributions to the problem.

For decades, corporate tax cuts and tax loopholes combined with near zero constraints on corporate pricing power have contributed to the perennial inflation problem. Both parties share blame.

Corrective actions could start with:

- The Federal Reserve upgrading its approach to measuring inflation so that it meaningfully tracks the affordability issues experienced by families and individuals.

- Both parties getting their heads around the issue of corporate pricing power and regulated monopolies and their combined role in perennial inflation. This issue impacts the constituents of both parties in very negative ways.

One big contributor to jobs...oh so inconvenient

Red states are the biggest beneficiaries of jobs and dollars from the green energy investments of the Inflation Reduction Act and some Republicans are rethinking their opposition to the IRA. See green energy projects bringing jobs to North and South Carolina. As noted by the Bloomberg info graphic, (go here for interactive version) GOP districts enjoy almost 4x more dollars from the Inflation Reduction Act.

AI Risk Database

So most people by now are aware of the risk in AI and many companies are starting to talk about this - which is great - but if you ever been part of these meetings you'll know that these tend to be ad hoc lists of the risks that people happen to be able to think of in the moment. You can't help but wonder, shouldn't there be a universal AI risk database that we all can use and contribute to?

Well good news...

MIT has released a living database of 700 categorized risks associated with different uses of AI. The AI Risk Repository provides and organized view of how, when and why the risks can occur, classified in seven domains:

- Discrimination & Toxicity

- Privacy & Security

- Misinformation

- Malicious actors & misuse

- Human computer interaction

- Socioeconomic & environmental harms

- AI system safety, failures and limitations

Having gone through the process of creating AI risk registers, I have a high regard for the work that went into this, and for the industry /society benefit it can provide. Recommend considering this as a potential benchmark or reference for any AI use your organization may be considering. Link here:

Snow vs Bricks - who wins in the next wave of AI?

Bloomberg ran a piece this week delving into the extreme rivalry between 2 cloud platform providers Snowflake and Databricks fighting for dominance in the next wave of AI:

This next wave could be bigger and more profitable than the fluffy elusive value yielded so far from LLMs trained on Internet data. Why? Because it will be trained on privately held data not available to the likes of Google and OpenAI.

Some of the buyer beware cautions shared in the piece:

- Both parties show a tendency to make hasty acquisitions just to spite the other party. That could spell trouble for customers who end up using that acquired capability for mission critical needs.

- Marketing team bonus programs aimed at stealing customers from the opponent...again not a recipe for trustworthy advice.

- They both depend on well capitalized cloud providers (AWS, Microsoft, Google) who have plenty of reasons and few barriers to "Sherlocking" both Snowflake and Databricks. If Snowflake and Databricks are so distracted one upping each other, this could be a risk - especially given the "next wave of AI" kind of stakes.

AI Coding Tools: Trust but debug

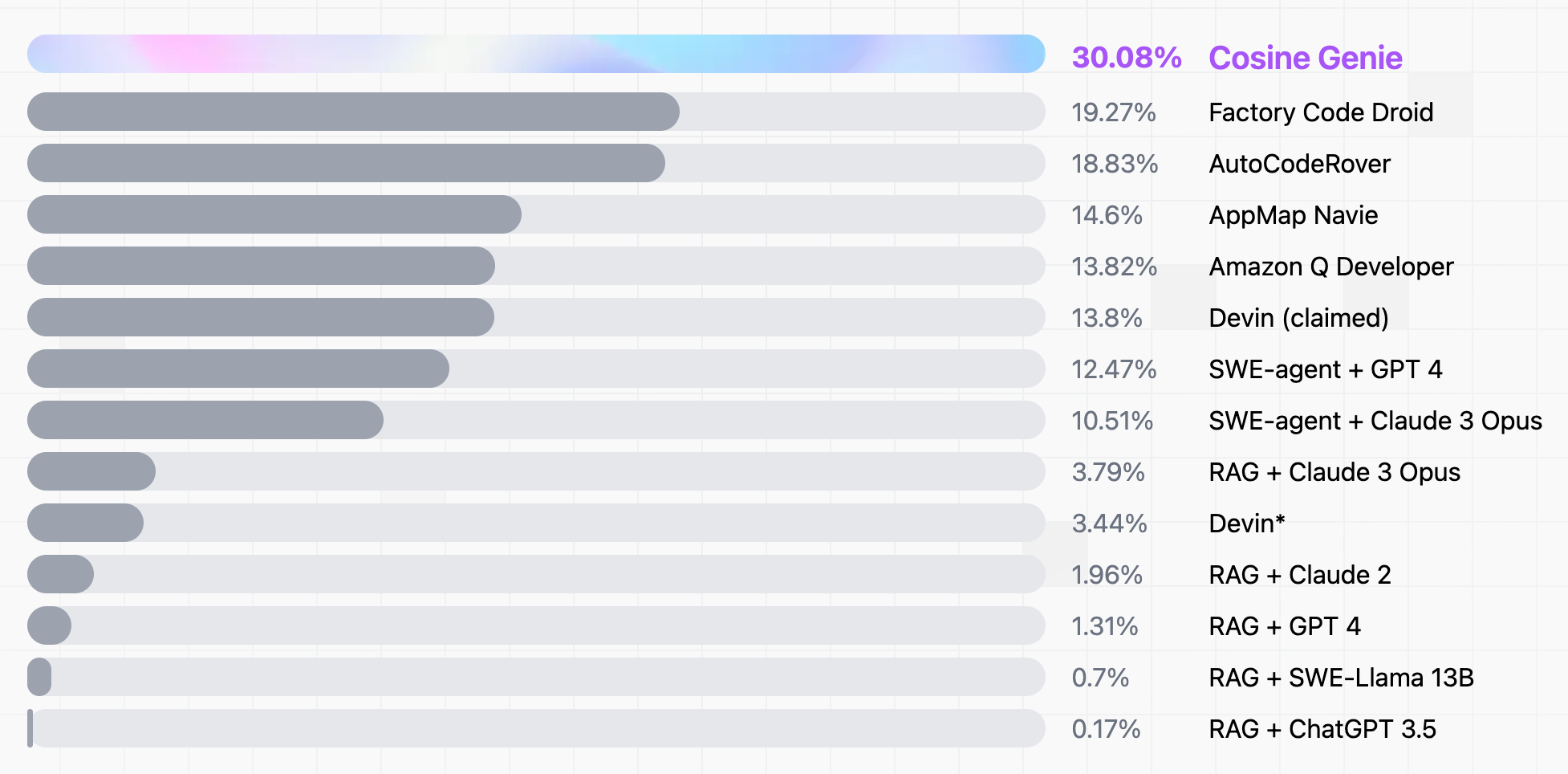

Guess which AI Coding Tool is the best in the world this week?

GPT40? ...Amazon Q? ....Factory Code Driod?

Answer: None of the above.

This week Cosine (a Y-Combinator startup) released a new technical report claiming that its Genie is the "World's best AI Software Engineer", boasting high benchmark scores and an architecture meant to mimic human problem-solving. It’s ambitious but not without flaws—like any other AI tool, it still needs a skilled developer to clean up the code.

Context:

Genie was tested against the SWE-bench - a benchmark for testing an LLM's ability to resolve actual software bugs that occur in the GitHub ecosystem. On August 13 OpenAI released a "human-verified" version of the SWE-bench where they culled out problematic / impossible to solve bugs & coding tasks. This is expected to boost the performance scores of the overall field of tools in this space.

Good question: did Genie get an advance access to this and test their tool with the human verified? Don't know. Genie also included a disclaimer at the end of their report, saying they would not be appearing on the leaderboard because their model is proprietary. And if you want to get really confused, go try to make sense of the SWE-Bench leaderboard's "Lite" vs "Verified" vs Full variations.

Muddled scoreboards aside, AI coding tools are getting better, but they’re still no substitute for expertise. The tool I use most (omitting names to protect the guilty) is decent, but frequently loses track of names it gave to specific functions or variables - it later ends up calling something it never defined for instance - as well as other examples of buggy logic. As AI tools continue to evolve and go mainstream, it's reasonable to expect a productivity boost, but perhaps more for those with solid debugging skills.

Signs of the times: consulting companies are pivoting from MBAs to more tech savvy job candidates because of the hype and demand for AI consulting services.

Why economic awareness & literacy matter in change leadership

The word's financial architecture is changing: Raoul Paul has an interesting new piece he calls the Economic Singularity - suggesting that by 2030 traditional economic frameworks will no longer be applicable (...you mean they're still applicable now? lol) :

"By 2030, the combined forces of AI, robotics, and renewable energy will transform every industry, challenging our conventional understanding of value, productivity, and economic growth."

This means it's important to pay attention to the data and find good vantage points that can help you track what's evolving.

One of the things we've always emphasized is the need for economic literacy. We've previously shared the The Evolution of Economics and how it's important to rethink economics as it continues to move from a theory driven to a data driven discipline.

I also am sharing here some of the key sources that together provide a good foundation for the S3T newsletter.

📊 Top Sources of Economic Indicators & Research

- Bureau of Economic Analysis (bea.gov) - latest economic indicators published by the US Dept of Commerce.

- CBOE Volatility Index or VIX Index - a market indicator of expected volatility of the S&P 500 Index (how much the market thinks the S&P 500 Index will fluctuate in the 30 days).

- Havre Analytics - Succinct notes on latest economic trends and developments.

- EPFR - macro insights on fund flows and allocations tailored to quants and economists.

- FiscalData API Documentation has open-source tools for tracking federal finance data.

- Bureau of Labor Statistics - job market data and indicators including a portal of Charts for Economic News Releases.

- Consumer Price Index (CPI) also from BLS

For the full list plus other high value sources, click the subscribe button and sign up for full access to S3T.

Nature Notes

Antarctica is greener than we thought per the first ever vegetation survey of the bottom of the globe. As shown below, the team found 3 categories - vegetation, lichens and green snow algae. The comprehensive study is chock full of excellent charts and photos.

Thank you for reading and sharing S3T. If you are enjoying S3T please give it a like or repost on LinkedIn or other platforms where you learn and share! This helps us with our mission of encouraging change leaders and innovators in their vital work.

Member discussion