3 Hints from DeepSeek, High Flyer vs Chips & Capital, PE outlook, annual goals, fed layoffs

What if the biggest breakthroughs in AI, leadership, and finance don't come from the usual power players—but from those who rethink the rules entirely?

🎧 You can also listen on Spotify

🔥 Sneak Peak at what's in this edition of S3T

1️⃣ 🤖 DeepSeek & AI Evolution: 3 Hints – A Chinese AI startup, DeepSeek, shocked markets with a low-cost, high-performance AI model using KV cache compression. This breakthrough challenges the idea that AI dominance is tied to big capital and powerful chips, signaling a shift toward more efficient, engineer-driven AI innovation. Markets reacted with volatility, reinforcing that AI disruption isn’t just about money.

2️⃣ ⚡ Change Leadership: Implementation Paths & Governance Evolution – This week's learning segment explores how change leaders can drive impactful solutions faster. Traditional methods like legislation are too slow; instead, modern platforms (software, blockchain, etc.) enable rapid, scalable change. If you're a young executive or founder, understanding these shifts is key to leading in a fast-moving world.

3️⃣ 🦅 Federal Layoff Recovery Kit – If you were laid off from your federal job, there's a free Federal Layoff Recovery Kit to help you turn this challenge into a Level Up. The kit is adapted from the original Layoff Recovery Kit and is based on lessons learned from past layoffs.

4️⃣ 📉 Private Equity & Market Trends – While private equity (PE) deals, especially in healthcare M&A, are gaining traction, valuation gaps remain a huge risk. Many companies are overvalued, but buyers aren’t biting. A pile-up of overpriced assets is restricting capital flow for new investments, making it critical to understand realistic valuations and avoid costly misjudgments.

5️⃣ 🌎 S3T Economic Dashboard & Signals – Stay ahead with real-time US & global economic indicators and key insights on inflation, debt, and macroeconomic risks. Experts warn that market overvaluations, debt levels, and misleading inflation metrics could lead to long-term financial distortions—or even a crisis if not addressed.

🚀 Want deeper insights? Check out the full lessons and reports to stay ahead in an evolving world!

Opinions expressed are those of the individuals and do not reflect the official positions of companies or organizations those individuals may be affiliated with. Not financial, investment or legal advice, and no offers for securities or investment opportunities are intended. Mentions should not be construed as endorsements. Authors or guests may hold assets discussed or may have interests in companies mentioned.

🦅If you were laid off from the government

If you are among the thousands of dedicated federal employees affected by the recent layoffs or early retirements under the new administration, here is a heartfelt thank you for your service and best wishes for your next chapter. You may be feeling frustrated, confused, or even betrayed after giving years of service to your nation, ensuring that essential functions ran smoothly for the American people.

I created this free Federal Layoff Recovery Kit to share lessons I learned about turning a layoff into a Level Up. This version is adapted from the original Layoff Recovery Kit. This week I wrote this adapted version, shared it with impacted individuals for feedback and wanted to share it here. Click here for your Federal Layoff Recovery Kit.

[change leadership learning series]

This week's lesson: Implementation paths and the evolution of governance

This continues the 201C lessons which focus on activating Change Leadership at the Industry or Macro Level. See an overview of the full Change Leadership Learning Series.

How to bring something to reality. How to get the desired outcome - faster. These are the top questions on the minds of change leaders.

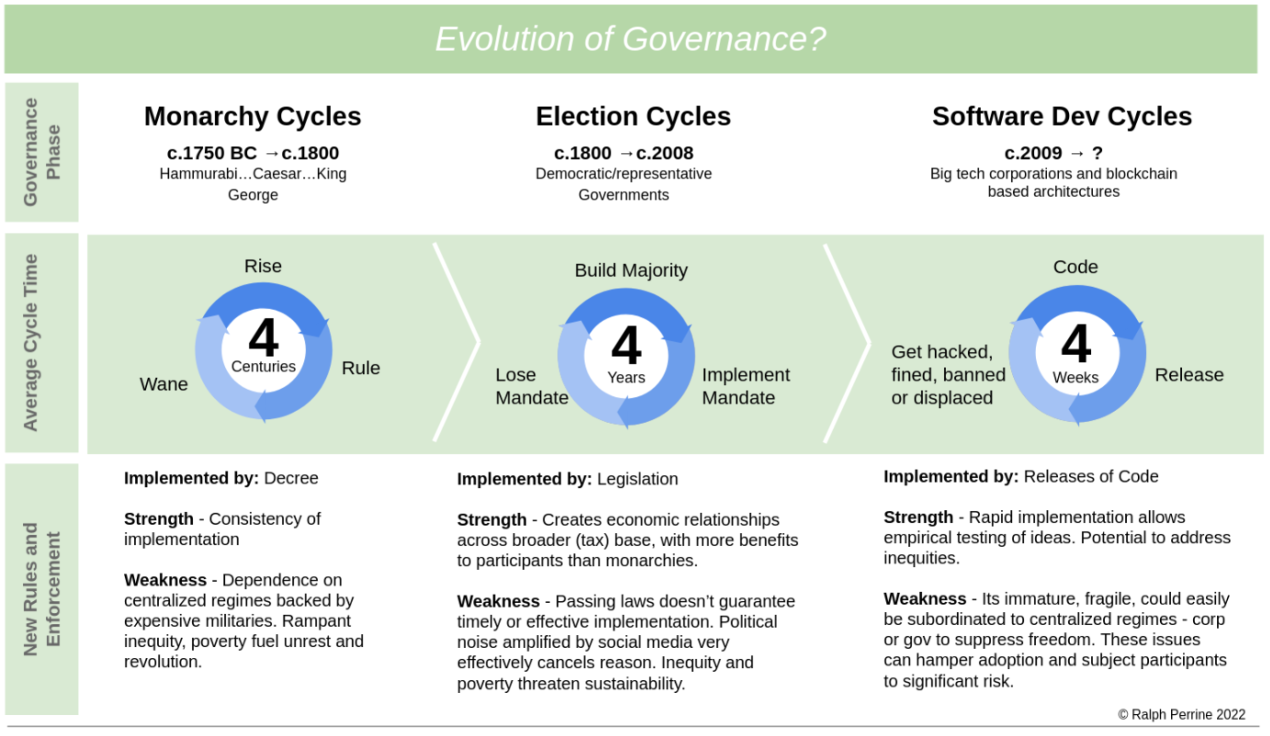

In a world where urgency and complexity collide, the ability to implement impactful solutions quickly is the ultimate competitive edge. This learning segment dives into the evolution of implementation platforms—from ancient decrees to modern software releases—and reveals how today’s leaders must harness the fastest, most scalable paths to drive change.

Discover why traditional methods like legislation, while familiar, are often too slow and gridlocked to keep up with the pace of innovation. Instead, explore how software-driven platforms—think Facebook, TikTok, and blockchain ecosystems—are revolutionizing the way we solve problems, enabling rapid iteration, empirical learning, and global scalability at unprecedented speeds.

Learn how decentralized technologies like blockchain are not just tools but transformative forces, combining code, currency, and governance into programmable layers that empower users and redefine what’s possible. From Bitcoin’s rise to the next generation of financial ecosystems, this article shows how the future of implementation is already here—and how you can be part of it.

For young executives and founders, this is your top strategy for cutting through complexity and leading change in a fast-moving world. Whether you’re building a startup, launching a new initiative, or reimagining an industry, the insights here will inspire you to think bigger, move faster, and create solutions that matter. Don’t just adapt to the future—shape it.

Ready to transform your approach to problem-solving? Dive in and discover how to turn your boldest ideas into reality.

Governance (the way nations and industries implement and enforce policies) is evolving. This evolution gives change leaders new options. Understanding this evolution can help you understand the dynamics that impact large change efforts, find the way forward when things seem hopelessly blocked.

Go to this week's lesson: Implementation paths and the evolution of governance

[emerging tech]

🐳 3 hints DeepSeek gives us about the evolution of AI

This week Chinese AI startup DeepSeek drove panic in the tech heavy stock market by announcing DeepSeek an advanced AI model that is far cheaper to create but achieves performance that is competitive with US AI models. The model relies on a breakthrough "KV cache compression" to enable higher throughput with limited memory. See Jan 22 DeepSeek R1 paper here. The lead developer Liang Wenfeng (who is also co-founder of a quant hedge fund) seems to have leapfrogged the competition in 20 months with relatively little funding and outdated Nvidia chips.

"DeepSeek’s model does not fire on all cylinders at all times but rather gets activated at different phases of the total compute cycle. It predicts which part of the model would need to activate and thus keeps the computational workload at a minimum. This is quite different than Meta’s, Google’s, and Open AI’s LLMs that are on full tilt from the start." - Shams Afzal CIC

#1 Chips & capital don't guarantee AI dominance

As Azeem Azar notes, DeepSeek has been in development for some time and its unusually efficient approach was at least in part born from trade restrictions on more powerful chips. This pushed them down a road of "more engineers than data centers" and in the process built something that puts OpenAI in a really uncomfortable position.

But if you look at this detailed historical timeline of High-Flyer, the quant hedge fund that formed DeepSeek, you'll see something else: this team has deep roots in

- non-conventional experimentation with math and AI,

- algorithmic trading and

- building supercomputers.

Their creative engineering comes from a long history of similarly complex problem solving under constraints: They couldn't just throw more hardware or datacenters at the problem.

#2 Volatility is the new normal

US Markets reacted sharply to the DeepSeek news, with huge selloffs. While some see this as bullish stimulant that will drive more focused innovation and growth, the selloff is also a reminder that markets are concentrated to the point that extreme volatility is probably the new normal.

One final take: DeepSeek has shattered the notion that AI excellence can only be achieved by a few highly capitalized players. It turns out, capital isn't everything.

#3 The 24/7 market is here - Wall St needs to catch up

The DeepSeek event underscores the growing need for U.S. markets to consider extended trading hours. DeepSeek's sudden appearance and the subsequent market reactions unfolded during international hours, leading to significant movements in tech stocks before U.S. markets opened.

While some Wall Street firms express concerns about the complexities of 24-hour trading—including risk management, staffing, and technological demands—the evolving global financial landscape may force this shift. The FT just published a litany of Wall St's reasons for resisting the 24/7 cycle. All of them will require change/discomfort. None of them are impossible.

The cryptocurrency markets have long demonstrated the feasibility of 24-hour trading, offering investors the flexibility to respond to global events in real-time. In contrast, traditional U.S. stock markets have adhered to set trading hours, which can leave investors vulnerable to developments occurring outside these periods. (Growth opportunity for the likes of Coinbase?)

[Macro]

🌎 S3T Economic Dashboard - Top 500+ US & Intl real-time economic indicators, plus latest significant developments and updated outlook.

🔮 S3T Signals - Curated list of top Economic Data & Insight sources for maintaining an independent forward perspective on economic realities that will impact your family, teams, customers and communities.

US Private Equity cautiously optimistic - but overvaluations still a key risk in 2025

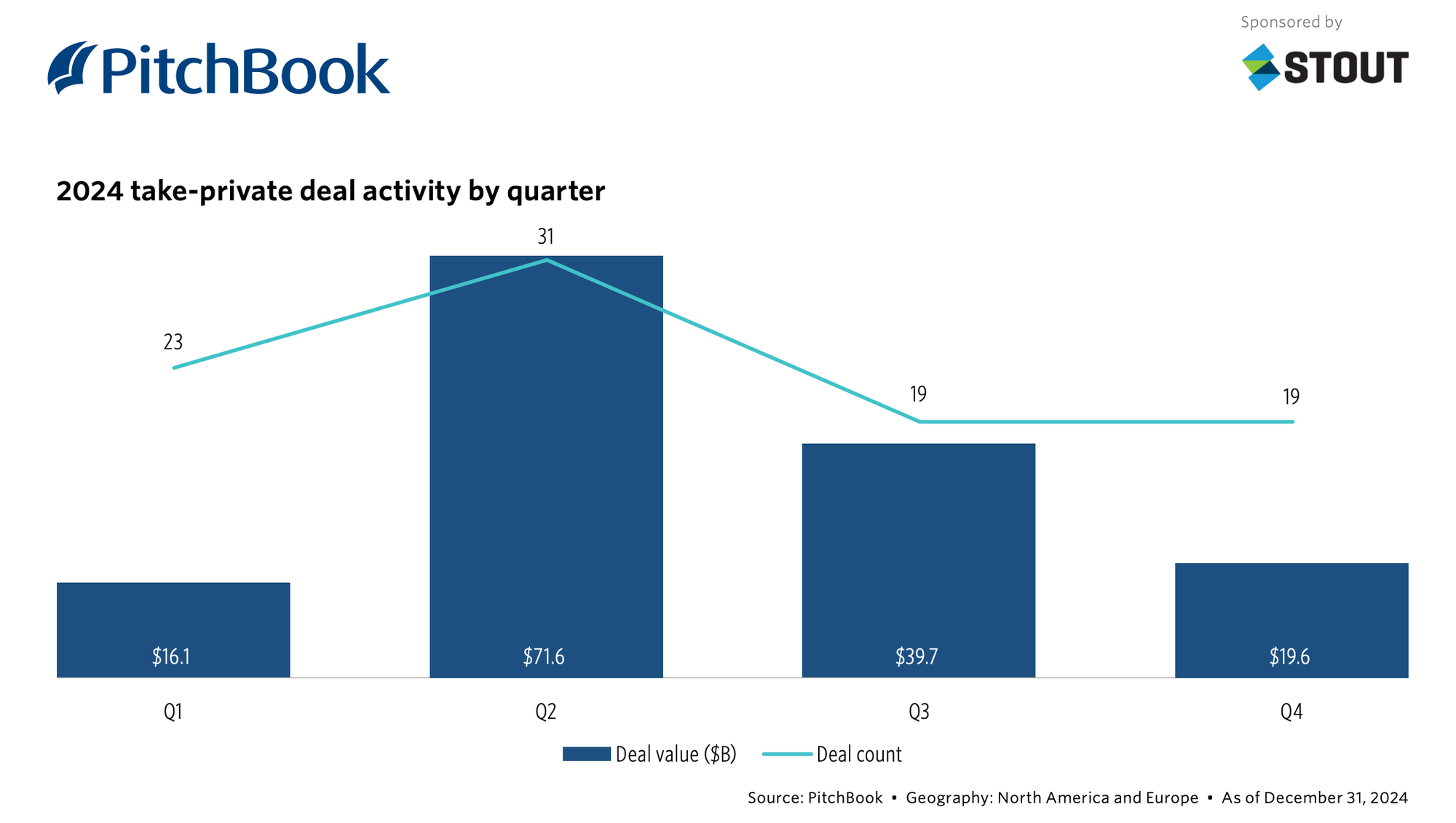

Highlights from the Pitchbook 2024 US Private Equity Report:

- Positives: PE including Healthcare M&A picked up steam in 2024, and valuation gaps are narrowing.

- Negatives: There was a slump in fundraising the last half of 2024 (see chart below) due to some gloom in the macro picture: the prospect of tariffs, US debt (interest payments and large budget cuts), higher inflation, and high levels of consumer debt.

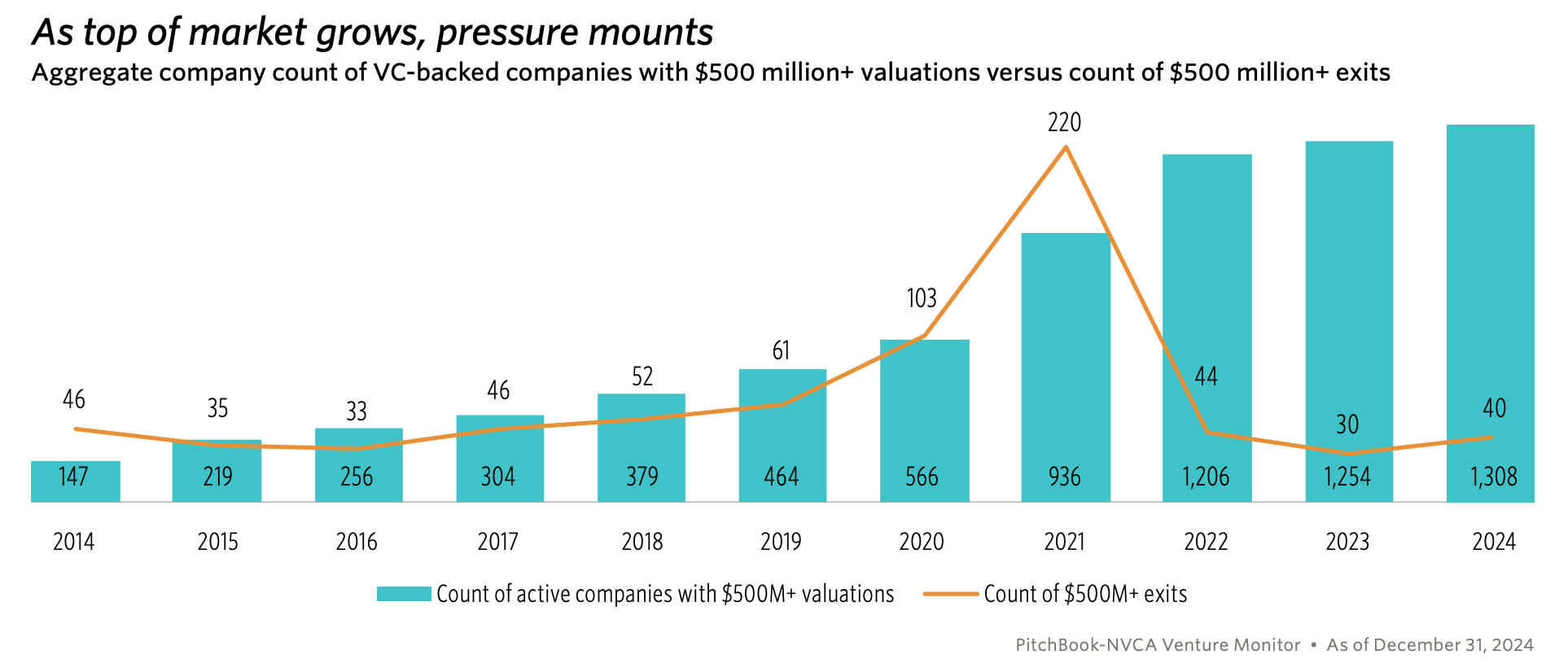

Factor to watch: how bad is the valuation gap disease?

This report and others mention the recurring issue of valuation gaps - where a company or portfolio is estimated to be worth x amount, but subsequently proves to be worth a lower amount. This leaves investors with the unpleasant dilemma of either exiting with losses, or waiting for longer than usual in hopes of finding a buyer that will pay a higher valuation.

When this issue is widespread, it causes a pile up of overvalued assets all waiting for an eventual sale, which in turn reduces capital available for new investments.

The Pitchbook NVCA chart below compares the number of pre-exit companies with $500M+ valuations vs. post-exit companies with $500M+ valuations. In simple terms, there are an unprecedented number of high priced companies but no one's buying them.

Clearly something unhinged between 2020-2022. In the years leading up to that point, the "fair market" prices of comparable assets gradually rose amid "easy money" and broad market conditions. Joseph Carson offers a relevant diagnosis - excerpt here (bolds added for emphasis):

"Over the past sixteen years, from 1998 to 2024, the average S&P 500 P/E ratio was 26.7. In contrast, during the preceding fifteen years, from 1983 to 1998, it averaged 15. Is this just a coincidence, or could the alteration in inflation estimation for housing costs, combined with the Fed's emphasis on an inflation measure representing only half of the actual inflation rate experienced by people, partly explain this shift? This misleading measure of inflation and policy approach has led to maintaining official rates lower than they might have been otherwise, which benefit finance, especially equity investments."

Carson worries that the Fed and the financial establishment is unlikely to address these issues unless forced by a financial crisis.