4.25.2025 - What are we building?

Empires exploit, impoverish and collapse. Ecosystems enrich, nurture and renew. What are we building?

🎧 Click the player above to listen here, or listen on Spotify.

In this Issue

🌍 Greed vs. Stewardship: We face a critical choice—exploit rapid tech growth for short-term gains (greed), or use it to build equitable, lasting systems (stewardship).

⚖️ Ethics and Accountability: Stewardship demands intention, transparency, and legacy thinking—balancing innovation with responsibility, versus greed’s race to bypass accountability.

🧠 Leadership Rethink: Calls for a shift from profit-maximizing strategists to value-creating stewards—leaders who prioritize long-term wellbeing, not quarterly metrics.

🤖 Tech and Economic Shifts: AI, automation, and crypto are reshaping economies; the future lies in equitable ownership of automation, not nostalgia for industrial jobs.

🏠 Structural Insecurity: Rising inequality, unaffordable housing, and unstable job markets are fueling cultural and institutional distrust—highlighting the need for resilient systems.

💸 Redefining Value in Uncertain Times: Families and institutions alike are adapting to volatility—rethinking savings, investments, and the cost-efficiency of legacy systems like higher education.

What are we building?

Greed vs. Stewardship in an Age of Acceleration

Increasingly powerful tools—from algorithms to automation— give us the ability to move faster than regulations, faster than norms, faster than most can even comprehend. But speed is not the only thing that matters. Direction matters too. Right now, we need to take a hard look at a foundational choice:

Will we build a future based on greed, or on stewardship?

Greed says: "Take all you can, as fast as you can."

- Hoard resources.

- Maximize short-term gain.

- Exploit loopholes before they close.

- Externalize costs—dump them onto workers, the environment, the next generation.

Greed thrives in chaos and opacity. It leverages speed - not to build resilience - but to outrun accountability.

Stewardship says: "Build something worth having - and inheriting."

- Align power with responsibility and accountability.

- Balance innovation with care.

- Create structures that outlast you.

- Use today's tools to heal, uplift, and enable—not just to extract and exploit.

Stewardship operates with transparency, intention, and a sense of legacy. It asks not just “Can we?” but “Should we?”—and more importantly, “How can we do this in a way that benefits others too?”

Why this matters now:

- Economically: Many are questioning the sustainability of current models. Wealth gaps widen, housing and healthcare become unaffordable, and markets feel rigged.

- Technologically: AI, crypto, and automation offer immense potential—but who benefits? Who decides the rules? Who bears the risks?

- Culturally: Trust in institutions is eroding. Younger generations are demanding purpose, fairness, and shared prosperity—not just innovation for innovation’s sake.

The leadership we need next:

- Leaders who don’t confuse fiscal reports with value creation.

- Founders who see humans as more than “user metrics.”

- Capital allocators who care more about long-term wellbeing than quarterly returns.

In short: We need stewards, not just strategists.

Greed is fast. Stewardship is enduring. And in this moment of rapid change, the choices we make—individually and collectively—will determine whether our work leads to collapse… or renewal.

Strive to build ecosystems, not empires. Empires exploit and impoverish. Ecosystems enrich and nurture. That's because they're designed and built differently. What are we building?

Further Reading from S3T.org:

- Navigating a World in Flux: Insights into adapting leadership amidst rapid changes.

- Election 2024: A Reckoning with Economic Inequality: Discusses the growing economic disparities and their implications.

- Defining Change Leadership: Explores the principles of effective change leadership in today's context.

- Beneath the Headlines: The Shift from Theory-Driven to Code-Driven Economy: Examines the transition in economic paradigms influenced by technological advancements.

[economic signals]

🔬Overlooked: key details about tariffs

Lyn Alden gives a best ever explainer of the overlooked details re: Tariffs & the US Trade Deficits. Highlights:

- The U.S. trade deficit is tied to/driven by the global system built around the U.S. dollar as the reserve currency.

- Having the Dollar as the global reserve currency is - in some ways - a huge advantage for the US but it doesn't benefit all Americans equally. It actually disadvantages regions of the US where the economy is/was driven by manufacturing.

- The current reserve currency system has been in place for ~50years - and in US manufacturing hubs the cumulative effect of 50 years of trade deficits has been destructive, and in Alden's view is helping to drive a significant political shift.

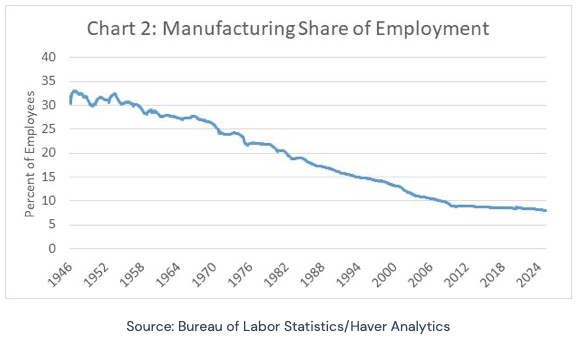

Peter D'Antonio and Daniel Golden bring some additional dimension to this picture in their review of US manufacturing job trends. Manufacturing as a share of total US employment has been steadily falling since WWII:

But overall employment hasn't fallen at this same rate...so what happened? The authors point out 2 factors:

- Manufacturing productivity has doubled in the US thanks to automation...so fewer workers are needed for a given level of output.

- In the US, the long trend is rising demand for services, and people spending more and more money on services vs goods.

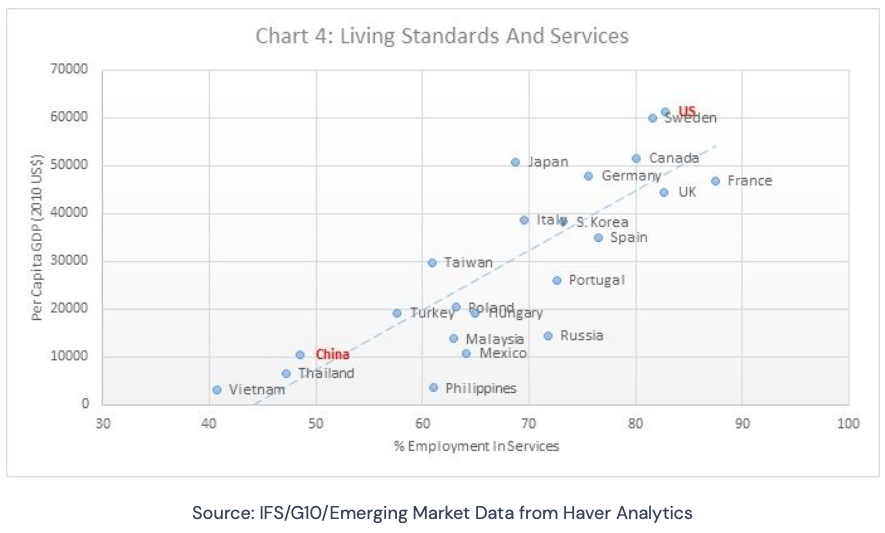

In addition, across all countries, there is an interesting relationship between standards of living (as measured by Per Capita GDP) vs percent of citizens employed in services:

The more affluent a nation is, the more likely it is to have a higher demand for services vs goods. The authors conclude: "US is in an entirely different place developmentally and should not preoccupy itself with trying to match China’s manufacturing and trade performance."

My Take

Trying to create more assembly line jobs feels short sighted, given the coming waves of AI driven automation and robotics. And, even the services economy isn't likely to remain a haven of employment if it is disrupted by humanoid robots and hyper-automation - as trends suggest it will be. Manufacturing and Services both are at risk.

Instead of hoping for a 2nd US Golden Age of Manufacturing where we just go back to tethering workers to assembly lines, we should be building a Golden Age of Automation Ownership where we have figured out how to give people opportunities to:

- Own shares of robotic assets: stock ownership in commercial interests that run fleets of robots for specific purposes, or tokenized ownership in on-chain agents that provide services or orchestrate the activities of robots.

- Launch their own companies that use teams of robots to provide services - services to humans, services to the environment, and don't overlook services like maintenance, shelter, recharging etc for robots themselves.

- Otherwise harness the value delivery / value creation of robot workers and automated agents.

🌪️Weathering the storm

Ramit Sethi (of the Finance for Couples podcast) is now recommending that families have a 12 month emergency fund due to increased time required to find jobs (now avg of 6 months) and increased chances of a recession.

The advice also makes increasing sense in light of longer term trends toward automation and humanoid robots. See 15 Insights on the Impact of Humanoid Robots on the job market.

Families aren't the only ones feeling the pinch. Yale may divest a significant chunk of its private equity portfolio to get cash on hand to make up for cuts in government funding. Other universities are doing bond issues and similar moves, due to a mix of economic pressures. Barron's deeper dive here.

The value prop vs costs of universities is under review. While the value of research is undeniable (across medicine, environment, tech etc), the efficiency of research, the ratio of effort to value is a factor that does not seem to have gotten enough scrutiny. Same can be said for efficiency of administration - the ratio of admin vs teaching staff.

Other indicators

- US existing home sales fell sharply in March

- NLW sees recent Bitcoin rise as possible signal of loss of confidence in USD.

[emerging tech]

- Character.AI's new video generation model AvatarFX creates animated characters, generating video from pre-existing images.

- Nari Labs new voice model is rocketing to the top of the Hugging Face leader board. Try it out here.

- Microsoft's Work Trend Index Report notes the rise of Frontier Firms using AI agents as digital workers. Access full set of materials here.

- Anthropic anticipates its AI Models may become sentient and need someone to look out for their welfare 🙄 ...ok....

Thank you for reading and sharing S3T! Have a great week!

Opinions expressed are those of the individuals and do not reflect the official positions of companies or organizations those individuals may be affiliated with. Not financial, investment or legal advice, and no offers for securities or investment opportunities are intended. Mentions should not be construed as endorsements. Authors or guests may hold assets discussed or may have interests in companies mentioned.

Member discussion